Purchasing a residential property over £125,000, whether as a homeowner or Buy-To-Let landlord means having to pay STDLT (Stamp Duty Land Tax).

Treasury coffers have netted close to £9.3 billion in SDLT receipts on 1.1 million residential transactions across the UK in 2017–18.

While sales volumes rose by just 1% over this last year, residential tax receipts rose by 8%. The mean amount of SDLT paid per residential transaction was £8,700.

Over a quarter of a million (252,000) properties were purchased as additional dwellings in 2017-2018, up 9% on 2016/17 and these accounted for 44% of all residential SDLT receipts. The 3% element alone has netted the government just shy of £1.9 billion.

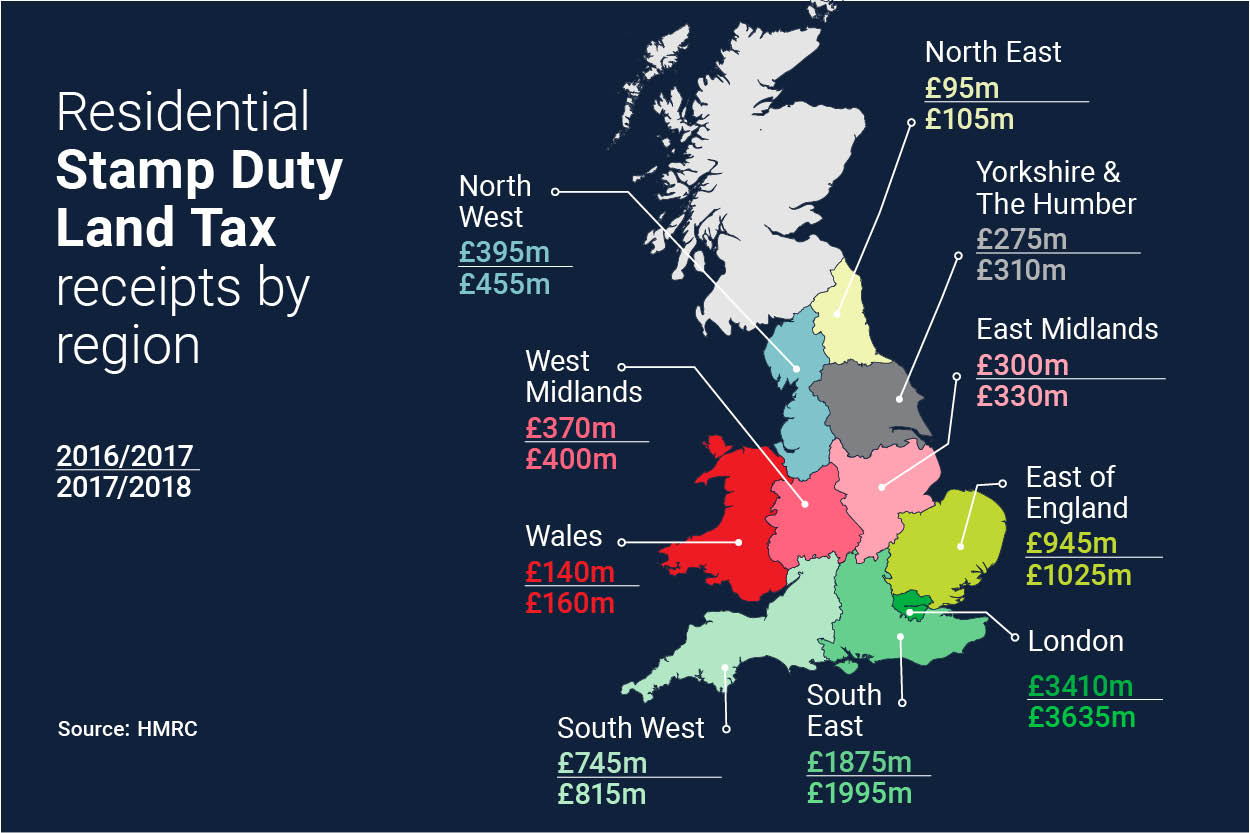

Although sales volumes across London, the South East and East of England fell, residential stamp duty intake in all regions increased. London accounts for 39% of all residential SDLT receipts, with Westminster and the Royal Borough of Kensington and Chelsea contributing just over £1 billion between them.

Here in the North West, a 15% rise can be observed from the 2016/2017 to the 2017/2018 period.

When it comes to being a Buy-To-Let landlord or property investor, accounting for SDLT is certainly something that needs to be done upfront before expanding your portfolio.