Across the UK there are just over 2.3 million students in higher education studying on a mix of undergraduate, postgraduate, full-time and part-time. Over three-quarters, 1.84 million are students studying on full-time or sandwich courses (often a year in industry or abroad) who require accommodation while they undertake their studies.

One in five students choose to live at home, a figure that has remained unchanged over the past three years. One in six however (17%) now live in their own residence (a property which may be owned or rented by them), up from 15% in 2014/15. In addition, nearly 30% of students, mainly those in their second or subsequent years of study live in rented accommodation (temporary arrangement, such as a yearly house share). In the 2017/2018 academic year 850,000 students either lived in their own residence or rented accommodation.

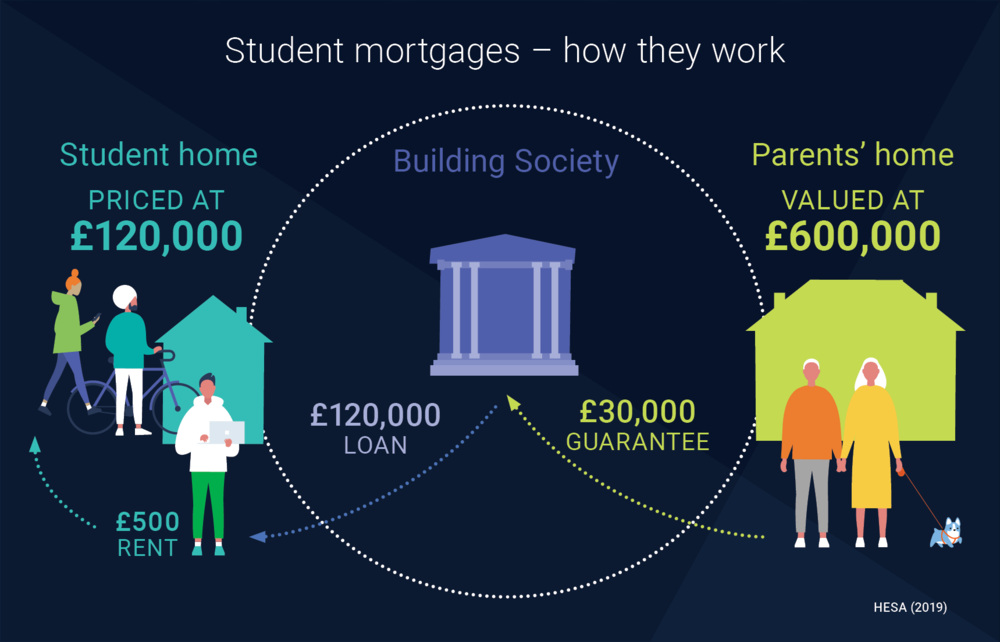

Buy for Uni mortgages have recently entered the marketplace and are now offered by three Building Societies. They allow students to buy a property while at university and pay the mortgage with the rent they charge other students.

Students don’t need a deposit as they can borrow 100% of the property value. They also pay little or no stamp duty, however there are no capital gains tax upon sale. Rental income is likely to be free of tax because the student has their own personal tax allowance (£12,500) and the tax-free rent-a-room allowance (£7,500). In effect, it’s a large tax-free income for students.

So, what’s the catch and what does this mean for landlords operating both in and out of the student accommodation market? Firstly, the 25% deposit required by lenders is put against the student’s parents’ property. They don’t have to pay anything upfront but are liable for the entire loan if the regular payments stop, much like a guarantor in a regular rental property.

The interest rate on the loans is usually high, around 4.8% (this compares to the Bank of England current average mortgage rate of 2.4%), and if base rates rise these loans could become quite costly. The minimum house value a student can purchase is between £90-£125k and the maximum is between £300-£400k. The house cannot have more than three bedrooms and no Houses of Multiple Occupation (HMOs) are permitted.

Data from the Higher Education Statistics Agency (HESA) indicates the number of students studying on full-time courses in higher education has increased by 8.7% over the past three years, which poses the question of will we see more students accessing the housing ladder, becoming landlords to their friends and colleagues?

In the event that students take up the opportunity, the competition in the student letting market is going to increase against current landlords in the already crowded market. It does however pave the way for students to gain the experience of being a landlord early on; allowing them to have gained the necessary insight should they wish to invest in buy-to-let properties after graduation. In turn, this will introduce more landlords to appease the demand for the ever-growing rental market across the North West.

For more information on effective HMO property management or more general property management in the Manchester area and to stand out against any student landlords, give us a call on 0161 883 2525.