One of the main concerns in a post-Brexit world is what will happen to the property market. Many homeowners have expressed their concerns of property prices plummeting, which in turn will please many first time buyers and landlords or investors looking to snap up a bargain. Should property prices plummet however and as a landlord you manage to make the most of this turn of events, the next consideration is what will happen to the rental market?

Amidst a flurry of regulation changes to always remain on top of, as well as the forthcoming Tenant Fee Ban, Brexit poses one of the most significant impacts to our industry as we know it.

Ahead of the leave date in March, the signs of Brexit have already taken a grip on the nation. The fall of the pound and a property market decreasing in speed in some areas of the country are the initial telltale signs. Whilst the property market will inevitably claim some of the leading news headlines in the weeks to come, this will consist primarily of sales content rather than rental market news.

Supply and demand?

One of the common perceptions regarding Brexit is that less migration will lead to less demand on the property market; therefore less competition in the rental market but also to the potential detriment of void periods. There is still a noticeable lack of stock on the property market, despite the Government’s bid to construct 300,000 new homes per year. Couple this with affordability along with visible outcries from first time buyers that owning a home is simply too expensive, the rental market remains strong and favourable on that front to many prospective renters.

The English Housing Survey of 2015/16 showed that nearly 25% of all rental properties were occupied by people not originally from the UK. If this collective were to leave following the EU departure, there would be a significant impact on the housing market.

This statistic however does not comprise of where the majority of tenants move to new rental properties from.

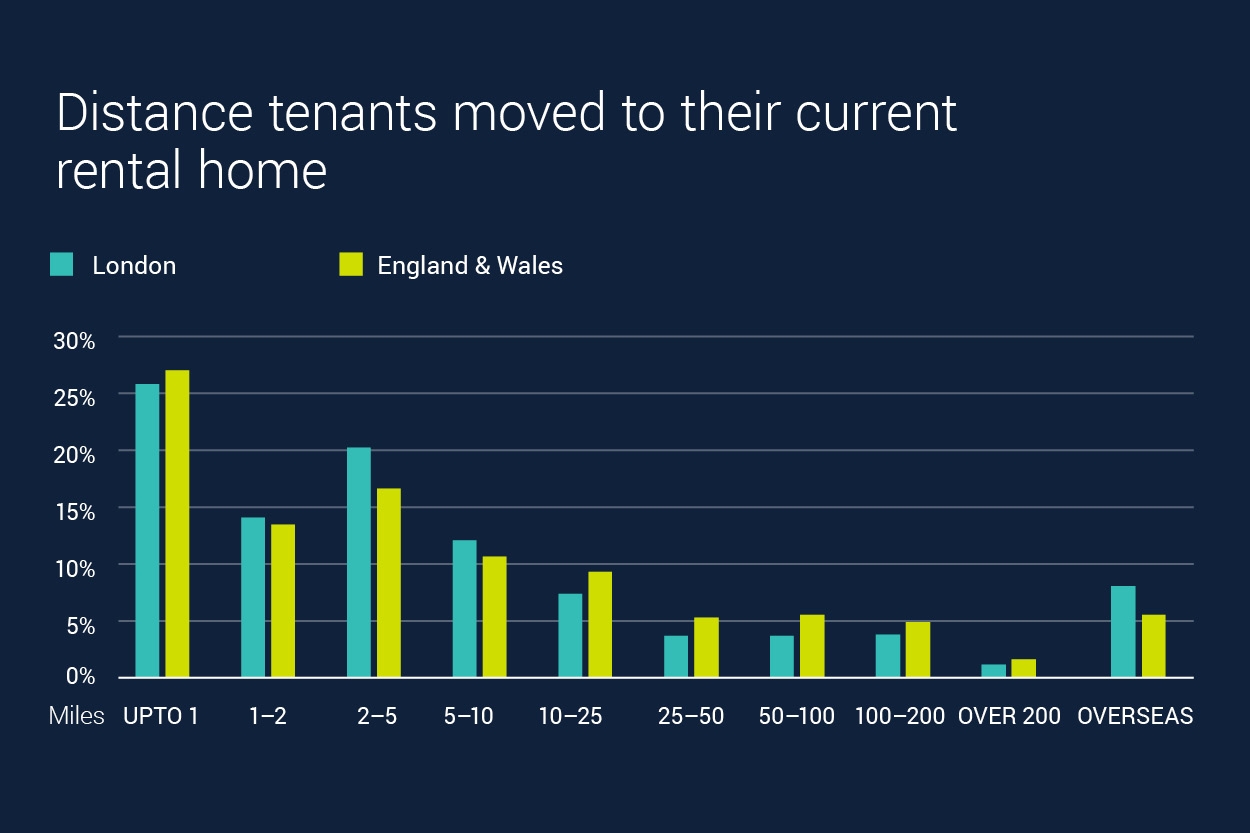

In 2018, over a quarter (27%) of tenants moved within a mile of their previous rental property, and two thirds (68%) stayed within ten miles.

At the other end of the scale, 8.1% of tenants starting new tenancies in London in 2018 moved from overseas. Despite political and economic concerns, this is actually an increase from 7.3% in 2017.

With renting offering more flexibility than ownership, some tenants have traditionally used the sector as a way to get to know a new area before committing to buying.

Indeed, the majority of tenants stay within their local area when moving home.

Rents on the rise?

Since the referendum, there has been a tidal wave of reports being published focusing on the resulting drop in demand, consequentially decreasing rental figures.

In theory according to the reports, if EU workers return home there will be an extensive range of empty properties awaiting new tenants. This of course means that landlords will be hit financially if they can’t find new tenants to let the properties.

In turn this will have a knock-on effect on rental prices. In areas where there is then an oversupply of rental properties, landlords would be forced to reduce rents or even sell entirely.

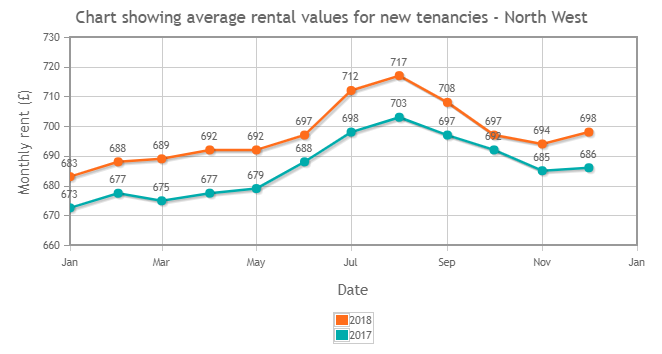

Yet on the other hand, there have been a counterattack of positive reports looking at the steady rise of rental figures over recent months.

According to the Homelet Rental Index, the average UK rental value was £763 in December 2018 (excluding London). This is up 0.7% on 2017’s end of year figure.

Looking more locally, the North West has seen a 1.7% increase in average rental values in December 2018 compared to December 2017, at £698 per month. In addition, the report also states Manchester was voted the best UK city to live in according to the Global Liveability Survey. This scores 140 cities worldwide out of 100 in the areas of health care, education, stability, culture and environment and infrastructure.

So what does Brexit really mean for landlords?

The answer is that there is no correct answer!

Due to the ongoing uncertainty, particularly strengthened by recent events in the House of Commons, an eventual outcome is still not clear. Ultimately there may be some great investment deals to be made on the property market in the event of homeowners and other landlords/investors panic selling. The key is to not panic and remain positive, remaining compliant with current regulations and striving to keep your current tenants happy.

If you’re looking for any potential investment opportunities in the North West or are wondering where the best areas to invest in are, call 0161 883 2525.